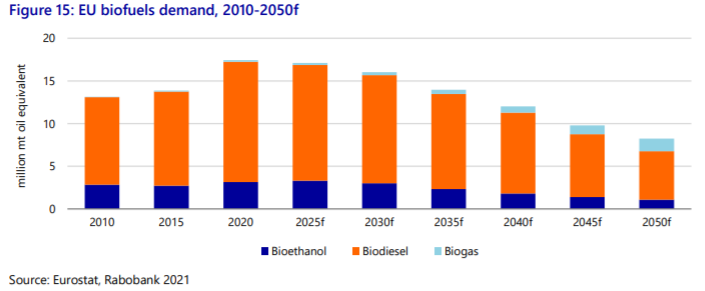

RaboResearch provides outlook on biofuels demand toward 2050, it will decline.

The path toward decarbonization in road transportation in the EU will require a multifaceted approach that, besides traditional biofuels, will also include the use of renewable electricity, green hydrogen, and other advanced biofuels. The adoption of these newer technologies, along with regulations that seemingly will ban the sale of internal combustion engine (ICE) cars by 2035, will slowly replace the vehicle fleet and negatively impact the demand for fossil fuel and biofuel as early as 2025, with a bigger impact after 2030.

In the years until 2025, biodiesel demand is expected to decline by 4% from 2020 levels, given the higher replacement rate of diesel vehicles. On the other hand, bioethanol demand is forecast to grow 5% to 2025, as the trend of total car fleet growth will compensate for the declining share of petrol cars in total new car sales, wich will still be higher than 50% of total new car sales.

The impact on biofuel feedstocks like grains, oilseeds, and sugar, as well as on the industry, will be twofold through 2030. On the one hand, the declining demand for biodiesel will not be enough to offser the phasing out of palm oil in EU biofuel production through 2030, wich will increase the demand for the other feedstocks fo fill the gap, spurring a cometition between rapeseed oil and used cooking and waste oils (uco). Although processing capacity of hydrogenated vegetable oil (HVO), also called renewable diesel, in the EU is expected to almost double by 2025, securing UCO supplies is likely to be constrained by competition from US biofuel makers and from producers of sustainable air fuels in the EU and other regions of the world, wich means that the demand gap for EU road transport biofuels is likely to be filled by rapeseed oil. On the other hand, the growth in ethanol demand by 2025 shoul benefit most ethanol players, especially since production has been well below capacity due to crop failures, but also due to proximity to countries with higher blending potential.

🔥 What about we co-host a webinar? Let's educate, captivate, and convert the biofuels economy!

Biofuels Central is the global go-to online magazine for the biofuel market, we can help you host impactful webinars that become a global reference on your topic and are an evergreen source of leads. Click here to request more details

Beyond 2030, the EU fleet´s replacement with electric and hydrogen vehicles will cause a greater impact to fossil fuen and biofuels, to a point that ir will become unfeasible to keep plants operating. Although demand for most feedstocks is expected to grow until 2025, the path towards net-zero emissions by 2050 means that the future of traditional biofuels and its feedstocks is discouraging, unless policies change to allow these biofuels to be used directly as sources capable of providing evergy with zero GHG emissions.

There is, however, grear uncertainty as to whether and at what speed these renewable technologies will take off at large scale. It is possible that unforeseen events in the future could affect the projected development and uptake of new vehicle technologies and advanced biofuels. Under these circumstances, conventional biofuels could potentially play a more significand role in achieving the EU´s emissions reductions targets.

READ the latest news shaping the biofuels market at Biofuels Central

RaboResearch provides outlook on biofuels demand toward 2050, it will decline, October 31, 2021