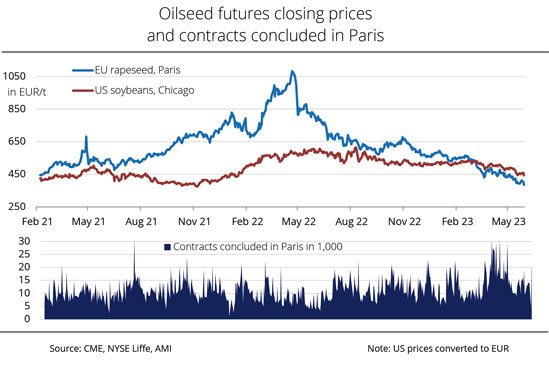

Sharp decline in rapeseed prices.

Stock exchange prices for rapeseed have been falling almost continuously since the beginning of the year. Temporarily, they even slid below the level of EUR 400 per tonne for the first time since November 2020.

According to the Union zur Förderung von Oel- und Proteinpflanzen (UFOP), this development is partly due not only to expected good global market supply of rapeseed, but also to imports of used waste oils and fats from China and biodiesel produced from them (UCOME – Used Cooking Oil Methyl Ester) in the amount of approximately 500,000 tonnes since the end of 2022.

Doubts have been raised in industry circles about the correctness of the certifications and required proofs of raw material origin. The UFOP has explained that if these biofuel volumes are counted double against quota obligations in Germany and other EU member states, such virtual crediting to meet GHG quota obligations reduces physical demand accordingly, especially for rapeseed oil-based biodiesel.

🔥 What about we co-host a webinar? Let's educate, captivate, and convert the biofuels economy!

Biofuels Central is the global go-to online magazine for the biofuel market, we can help you host impactful webinars that become a global reference on your topic and are an evergreen source of leads. Click here to request more details

The association fears that this puts a fundamental question mark over the credibility of sustainability certification. Consequently, the German government and EU Commission should take vigorous action. The UFOP has also underlined the need for more on-site inspections.

In line with the complex market situation, Paris futures market quotations for rapeseed have been falling virtually unchecked for several months. European rapeseed also lost in value based on slipping crude oil and palm oil prices and a temporary decline in US soybean prices. Both the US Department of Agriculture (USDA) and the International Grains Council (IGC) recently forecast that supply of rapeseed and soybeans will be more than adequate in the coming season 2023/24.

Above all, the EU could see the largest rapeseed harvest in five years with an expected 20.0 million tonnes. The current favourable weather conditions and good field crop development indicate that this might actually happen. Conditions are forecast to be favourable also in the weeks ahead, especially in France, Germany and Romania.

The August 2023 nearby closed at EUR 385 per tonne on 30 May 2023. At the same time a year ago, the close was more than double at EUR 814.75 per tonne as Russia’s invasion of Ukraine drove prices to unprecedented heights.

The situation of soybean prices in Chicago is different. Having firmed temporarily, they recently also slipped. The focus in the soybean market has been on growing and harvesting conditions in South America and the US. Lack of rain and excessive heat have diminished the yield potential of the ongoing soybean crop in Argentina noticeably.

By contrast, Brazil is set to harvest a bumper crop. Another reason for the decline in soy prices is dwindling demand for US deliveries. Brazilian competition currently dominates the export market, outstripping the US batches.

READ the latest news shaping the biofuels market at Biofuels Central

Sharp decline in rapeseed prices, June 5, 2023